International Tax Collection

~Mutual Assistance in Tax Collection~

Background

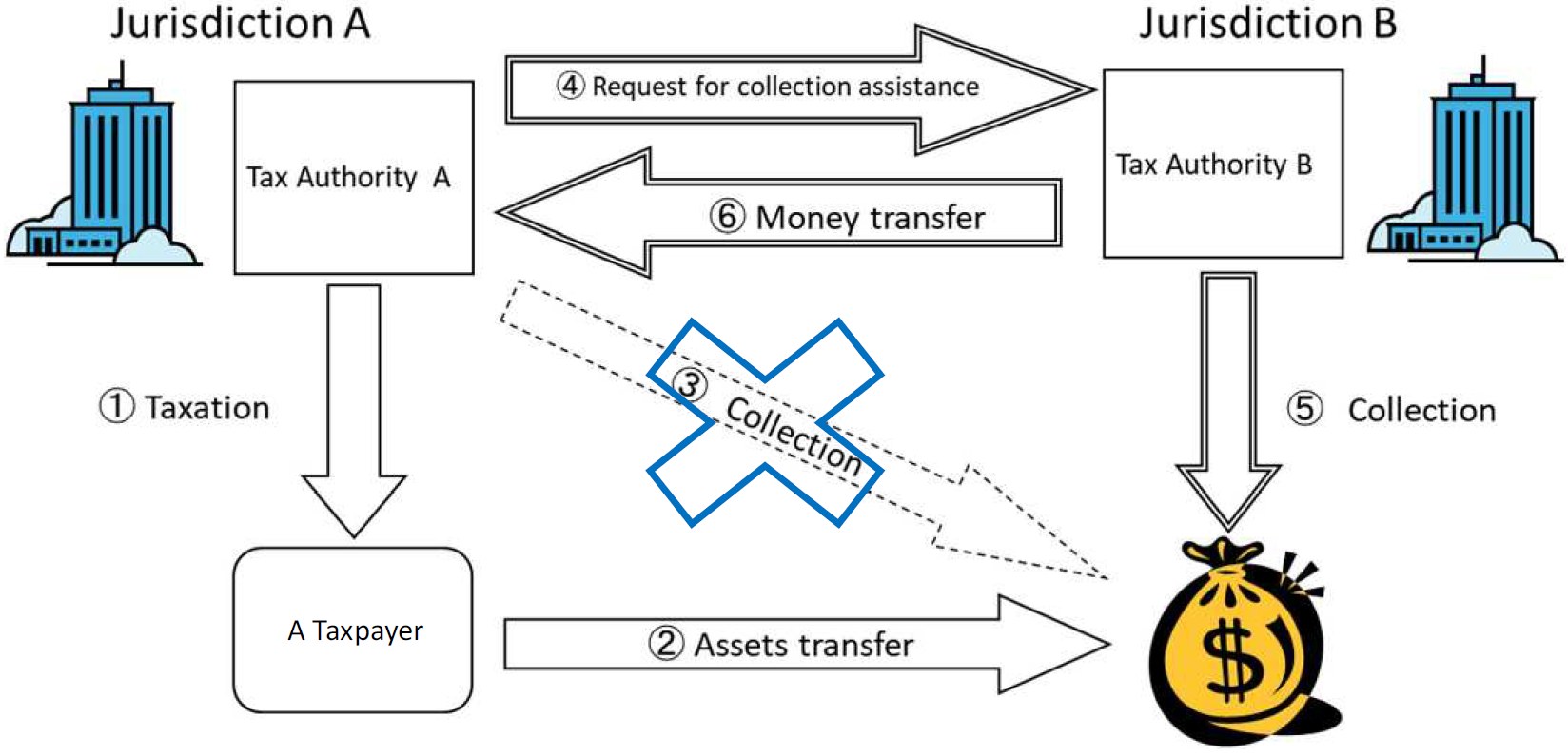

- As economic globalization develops, some taxpayers attempt to avoid tax collection by transferring their assets to other jurisdictions.

- To ensure taxation and collection remain fair and effective, tax administrations must properly deal with such international avoidance of tax collection under the tax enforcement constraint in other jurisdictions.

Overview of Mutual Assistance in Tax Collection

- Enforcement of tax collection is not possible outside the jurisdiction's territory.

- As part of mutual assistance in tax collection, Tax Authority A can request Tax Authority B to collect tax claims of Tax Authority A and vice-versa.

- This framework is based on the Convention on Mutual Administrative Assistance in Tax Matters or Double Taxation Treaties.

- The National Tax Agency of Japan (NTA) is actively promoting international tax collection under this framework.

- In accordance with Tax Conventions, the NTA can implement mutual assistance in tax collection with more than 80 jurisdictions (as of April 2025).

(Web-TAX-TV)

"Chase overseas assets! Efforts for International Collection"

- In this video released by the NTA, collection officers successfully use the framework of mutual assistance in tax collection to target a malicious delinquent taxpayer who had transferred assets to a foreign jurisdiction for tax collection avoidance.

- You can access the video on YouTube:

https://www.youtube.com/watch?v=Ara0fjphHNs

Some of the publications on this site are in PDF. To view them you will need to have Adobe Reader. Please download Acrobat Reader.