Status of the Initiative of Audits on the Real Estate Capital Gains of Non-Residents in corperation with the Australian Tax Authority

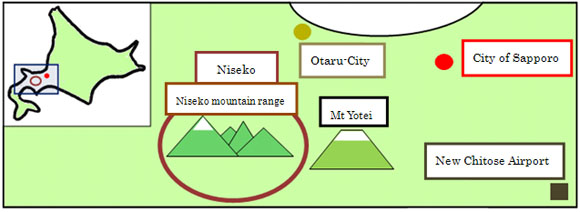

In recent years, there have been growing real estate transactions in the ski resort areas of Niseko district in Hokkaido, showing an increase in demand for holiday apartments. In cases where there is any income derived from a transfer of real estate located in Japan, both residents and non-residents are required to file their income tax returns in Japan. Based on the transfer registration of real estate, it was found that there was potentially a large number of cases where tax returns were not filed by non-residents even if capital gains had been realized.

Since many of such non-residents were Australians, the National Tax Agency (NTA) requested relevant information to the Australian Taxation Office (ATO) based upon the Article 28 (Exchange of Information) of the Japan-Australia Tax Convention, and conducted the audits.

(Note1) Under the Japanese domestic law, residents and non-residents are defined as follows:

Resident: An individual who has residence in Japan or has been residing in Japan continuously for one year or longer until present (Article 2 (1) (iii) of the Income Tax Act).

Non-resident: An individual other than the resident (Article 2 (1) (v) of the Income Tax Act).

The NTA will continue to audit related cases in cooperation with the ATO. At the same time, the NTA is taking this opportunity for providing explanation and information for non-residents about their obligations to file returns and pay taxes.

| The number of real estate registrations of transfer of non-residents | |||||

|---|---|---|---|---|---|

| Operation Year | |||||

| Operation Year 2012 | 14 | 10 | ¥56,060,000 | ¥5,610,000 | 123 |

| ($599,187) | ($59,961) |

(Note2) The number of real estate registrations of transfer of non-residents is the total number of non-residents including Australians who sold real properties in Niseko district in 2012, based on the registration documents of transfer.

(Note3) The exchange rate as of 9 October 2013 was used in converting Japanese yen to Australian dollars.

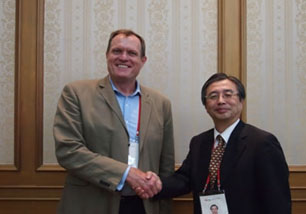

A bilateral Commissioners’ meeting between the ATO and the NTA was held back to back with the 43rd SGATAR (Study Group on Asian Tax Administration and Research) meeting in Jeju Island, Korea on 14th to 17th October, 2013.

For non-residents

When you earn a capital gain by selling assets in Japan, you will need to properly declare income in your tax returns in Japan. The national Tax Agency is making every effort to realize proper taxation by various means including the exchange of information not only with the Australian Taxation Office but also with tax authorities in other jurisdictions.

If you need further information or have any questions about the taxation on capital gains in Japan, please feel free to contact any of the offices listed on the linked page:

IF YOU NEED FURTHER INFORMATION, PLEASE CONTACT