Platform Taxation of Consumption Tax

Overview of Platform Taxation

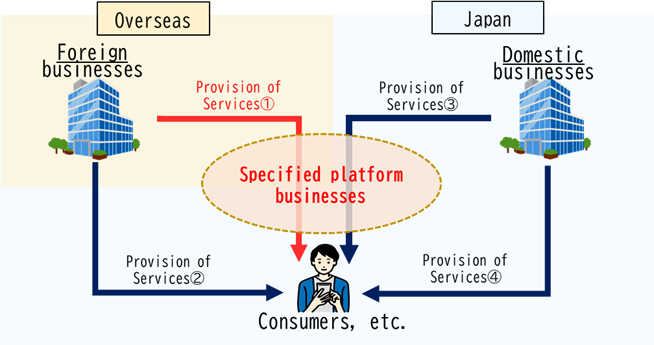

Businesses who provide electronic services such as application distribution for the consumers in japan (excluding provision of B2B (business-to-business) electronic services, hereinafter referred to as "provision of B2C (business-to-consumer) electronic services") are required to file and pay the consumption tax on such services, regardless of whether such businesses are domestic or foreign businesses.

According to the partial revision of the Consumption Tax Act, etc. on and after April 1, 2025, if a foreign business provides B2C electronic services via a digital platform and receives the compensation for the provision of such services via a specified platform business, such services shall be deemed as such specified platform business provides the services and the specified platform business is required to file and pay the consumption tax.

<Taxpayers Liable to Pay Tax on Provision of B2C Electronic Services before and after Revision of Consumption Tax Act>

| Provision of Services① | Provision of Services② | Provision of Services③ | Provision of Services④ | |

|---|---|---|---|---|

| Before | Foreign businesses | Foreign businesses | Domestic businesses | Domestic businesses |

| After | Specified platform businesses | Foreign businesses | Domestic businesses | Domestic businesses |

Brochures

- Platform Taxation of Consumption Tax(English)(April 2024)(PDF/433KB)

- 关于消费税的平台课税(2024年4月 )(PDF/645KB)

- 關於消費稅的平臺課稅(2024年4月 )(PDF/640KB)

- 소비세 플랫폼 과세에 대해서(2024 년4월 )(PDF/620KB)

Specified Platform Business Lists

Q&A

- Q&A about Platform Taxation of Consumption Tax(For Foreign Businesses)(PDF/408KB)

- Q&A about Platform Taxation of Consumption Tax(For Platform businesses)(PDF/936KB)

Some of the publications on this site are in PDF. To view them you will need to have Adobe Reader. Please download Acrobat Reader.